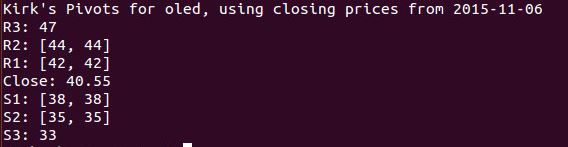

Getpivots (pivot-point-calculator) can be used for identifying areas of support and resistance in the next day’s trading session. Getpivots calculates pivot points for a ticker symbol using the most recent closing price data, and leverages several different algorithms which include the Floor/Classic formula, Woodie’s Formula, as well as Kirk’s formula.

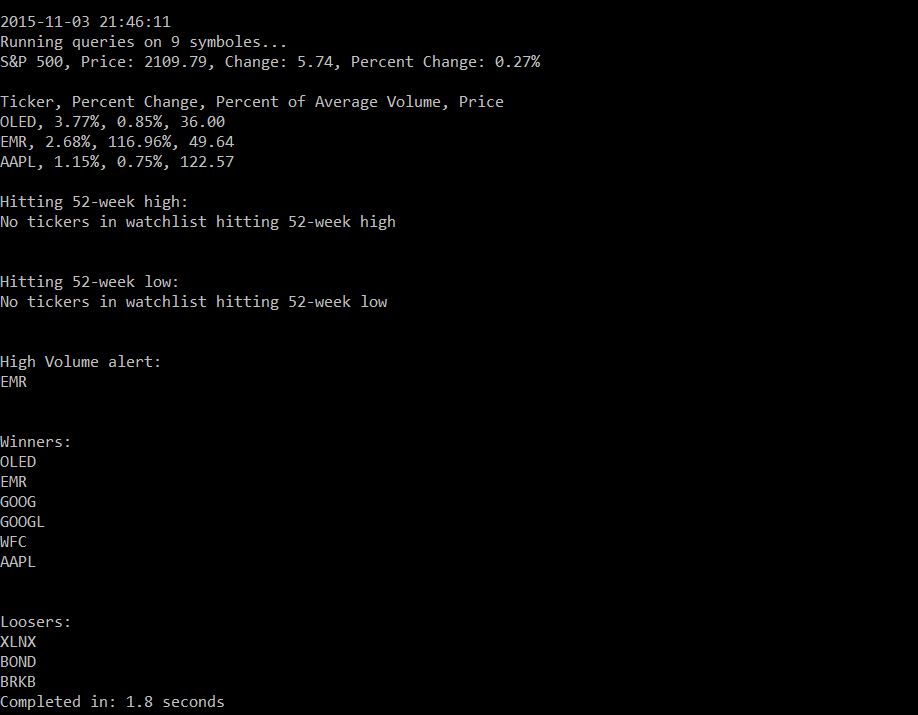

Getpivots complements Getstockinfo in a way that I could easily incorporate into my routine. While I’ve used spreadsheets for calculating the pivots in the past, it never really fit my workflow and always seemed to be some combination of too clunky, or too manual. With getpivots, I can quickly check each position of interest, and get pivots and context for tomorrow’s trading session.

Expanding on pivot points for those interested, pivot points indicate price levels of significance in technical analysis, and can suggest key areas of support and resistance, as well as trade-to targets when levels are broken. You can use them for determining the trend of a position… pivot points broken moving up, are bullish indicators. Pivot points broken when moving down, are bearish. Pivot points may be used in a situation where you want to put a limit order in to purchase shares in XYZ Corp., if the price breaks a pivot resistance level. Alternatively, you might consider setting a stop-loss order if a support level is broken.

How I use it:

I use getstockinfo to get a quick summary of all of my positions and any watchlists that I’m actively tracking, and then use the summary output as an input for my homework. One aspect of the homework is using getpivots to run though tickers of interest in getstockinfo. In some cases, next-steps would include reviewing charts, and then possibly setting triggers to buy or sell during the next day’s trading session. For buy and hold investors, you might use something like getpivots to help plan an entry, or exit a long-term position. Bottom line… getpivots is a tool which can be incorporated into your routine to help provide additional insight and help with your decision making process.

Installation: pip install getpivots

Usage: Getpivots.py –t tickersymbol –f/w/k -c

Example: python getpivots.py –t tickersymbol –f

Dependencies: Python 2.7, ystockquote, yahoo_finance, regex, argparse, datetime